In this 3 part lesson, we’re going to cover financial choices in detail. Everyday, people work, spend and save, and the implications for now, a year from now and decades from now, can be enormous. Many people’s relationships with money and the choices we make are most influenced by our parents – good, and bad. Many go throughout their lives without fully understanding the implications of their financial decisions.

For you, that ends today!

Financial success looks different to everyone, and can include:

- Owning a dream car

- A positive credit score

- Financial security

- Supporting family and loved ones

- Owning a home

- Retiring at 50

- Being able to travel the world

- Not fearing losing a job

It’s important you think carefully about how you define financial success for you.

Key questions:

- Where are you heading financially & what does financial success look like to you?

- Do you know how to track and manage your income and expenses in a sustainable and beneficial way over the longer term?

- Do you know your rights as a consumer, and how to behave ethically?

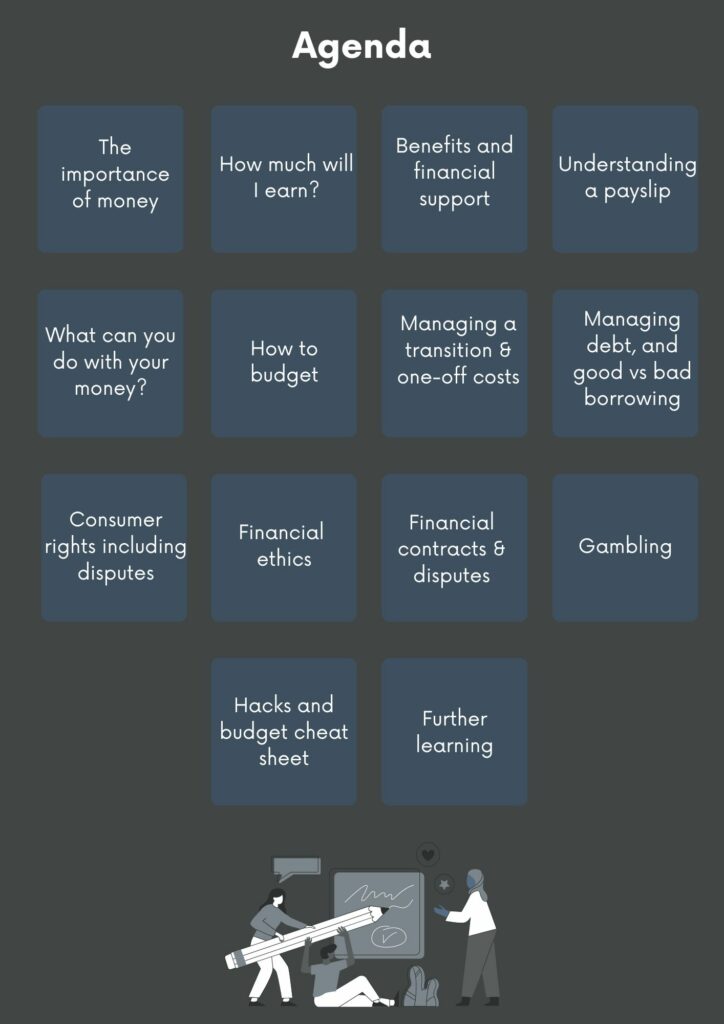

In this lesson (and the next two), we are going to help you answer the above questions and will cover the headlines captured to the right.

Let’s get into it!

The Importance of Money

“Too many people spend money they haven’t got, to buy things they don’t want, to impress people they don’t like”

Will Rogers – American Performer

Money can’t buy happiness, but it can buy security and safety for you and your loved ones. Money can cause a lot of problems if you don’t know how to manage it. Its fundamental for obtaining the things you need to survive, so an understanding of personal finance is essential. You need to be responsible with the money you earn and save enough for the future to ensure you will still have enough leftover when you can no longer work.

Task 1: Take 5-10 minutes to write down what financial success looks like to you, and what your long term financial goals are for the future.

“Wealth consists not in having great possessions, but in having few wants.”

Epictetus – Stoic Philosopher

How much will I earn?

Understanding your payslip

Of course, the majority of people will be in employment and the points above will be relevant to them. There is also another source of income for people that you need to understand. This is the benefit payment system. There are complexities to this system beyond the scope of this course but download our factsheet below to learn the key headlines. This information could be vital to you if you lose your job or are faced with serious health challenges.

Once you’ve had a good look at the factsheet linked above, you can begin to make some action plans for yourself.

Whether you just note down some key learnings to help it stick in your mind, grab your most recent payslip and check you understand it, or jut take a moment to recognise the importance of money, make sure you do something with what has been covered here befre moving onto lesson 2 in Financial Choices using the button below.